Home Technology Software 12 Best Enterprise Mapping Sof...

Software

CIO Bulletin

10 February, 2026

Spatial analysis has become a core function inside large organizations that manage distributed assets, run logistics operations, or serve customers across multiple territories. The mapping software market reached $3.82 billion in 2024 and continues to grow at a steady pace, projected to hit $7.45 billion by 2033. This growth tracks closely with how companies now use location data to inform everything from site selection and resource allocation to route planning and market expansion.

Enterprise mapping software differs from consumer tools in several ways. It handles larger datasets, supports multiple concurrent users, connects with existing business systems, and meets security requirements that smaller platforms cannot satisfy. These distinctions matter when an organization needs to process hundreds of thousands of data points without browser crashes or workflow interruptions.

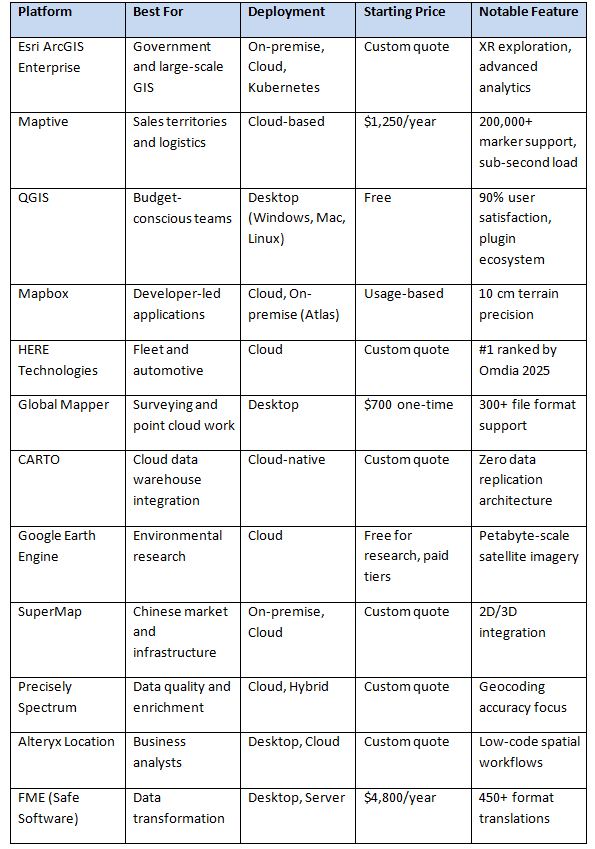

The platforms listed here serve different needs and budgets. Some excel at developer-focused customization, others prioritize turnkey analysis tools for non-technical teams, and a few offer open-source flexibility at no licensing cost. This guide covers 12 options with enough detail to help procurement teams, GIS managers, and operations directors identify which platform fits their requirements.

Before reviewing each platform, consider what factors matter most for your organization. Enterprise software purchases involve multiple stakeholders, and mapping platforms touch several departments at once.

Large datasets create performance problems for platforms built around browser-based rendering. If your organization works with more than 50,000 records at a time, test how each platform handles that load. Ask vendors for specific performance benchmarks and request a trial with your actual data.

Most enterprises already use a CRM, ERP, or data warehouse. Mapping software that connects directly with Salesforce, HubSpot, or cloud warehouses like Snowflake and BigQuery reduces manual data transfers and keeps analysis current. Look for platforms with pre-built connectors rather than those requiring custom API work.

Federal agencies and Fortune 500 companies require 256-bit encryption, single sign-on, audit logging, and compliance certifications like SOC 2, GDPR, or HIPAA. If your organization falls under regulatory oversight, filter your options by security capabilities before evaluating features.

Some platforms assume users know GIS terminology and spatial analysis methods. Others provide guided workflows for sales managers, operations coordinators, and marketing analysts who need answers without learning specialized software. Match the platform to your team's actual skill level.

ArcGIS Enterprise remains the dominant platform for government agencies, utilities, and organizations with dedicated GIS departments. The software appears consistently in Gartner rankings and serves sectors that require advanced spatial analysis with strict data governance.

Version 12.0 introduced several updates aimed at administrators, IT teams, analysts, and developers. The release includes expanded audit logging, real-time analytics capabilities, and a cloud-native deployment option running on Kubernetes. Organizations can deploy on Windows, Linux, or through their cloud provider's Kubernetes service, giving IT teams flexibility in how they manage infrastructure.

ArcGIS Data Pipelines arrived as a beta feature, offering no-code visual data engineering within the platform. This allows analysts to prepare and transform spatial data without writing scripts. The platform also added extended reality exploration features for immersive 3D analysis.

Pricing operates on a custom quote basis, and the learning curve remains steep for new users. Organizations typically need at least one trained GIS professional to manage the system effectively. For enterprises with existing Esri investments or complex analytical requirements, the platform provides depth that few competitors match.

Maptive focuses on business users who need spatial analysis tools without GIS training. The platform handles datasets exceeding 200,000 markers while maintaining sub-second response times, a benchmark that matters for sales teams managing large prospect databases or logistics coordinators working with extensive delivery networks.

The platform runs on AWS infrastructure with WebGL rendering, which prevents browser freezing during large map loads. In March 2025, Maptive released Maptive iQ, an update that added advanced spatial analysis capabilities to existing customer accounts. Drive-time calculations now use 300% more calculation points than previous versions. Testing by logistics teams showed routing errors decreased by approximately 22%, with fuel cost reductions of up to 15% in pilot studies.

Security features include 256-bit SSL encryption for data in transit and at rest, two-factor authentication, single sign-on integration, and audit logging. Enterprise clients include Amazon, General Electric, the US Department of Energy, and Coca-Cola. The platform connects with Salesforce, HubSpot, Zoho, Keap, and Pipedrive. Beta users report that Salesforce data synchronizes with less than 90 seconds of lag.

Every pricing tier unlocks 60+ mapping and analysis tools with no feature restrictions. This includes automated territory optimization, route planning with unlimited stops, drive-time polygons up to 8 hours long, and access to more than 50 US Census variables. Annual pricing starts at $1,250 for single users and $2,500 for teams. Customer support maintains a 9.7 out of 10 quality score on G2, and the platform recorded 99.9% uptime through 2025 with zero documented major outages.

QGIS provides a full-featured geographic information system at no licensing cost. The open-source platform runs on Windows, Mac, and Linux, making it accessible to organizations that cannot justify commercial software budgets or prefer open-source solutions for philosophical reasons.

User reviews indicate a 90% satisfaction rating based on 284 reviews from 3 recognized software review sites. The platform offers geoprocessing tools for buffering, clipping, and spatial joins, along with a plugin ecosystem that extends core functionality. The QGIS2Web plugin, for example, allows users to create web maps directly from their projects.

QGIS 4.0 will release in February 2026, with the first long-term release in the 4.x series scheduled for October 2026. This timeline gives organizations planning their software stack a sense of when to expect major updates.

The platform requires more technical knowledge than commercial alternatives. Users typically need familiarity with GIS concepts and some comfort with software configuration. For teams with that expertise, QGIS offers capabilities that rival expensive commercial tools. The active community provides documentation, tutorials, and plugin development that keeps the platform competitive.

Mapbox serves developers building location features into applications. The platform powers maps and navigation in products used by millions of people daily, and its Spring 2025 release introduced several features aimed at enterprise customers.

The new Geofencing API for iOS and Android allows companies to define custom geographic areas and trigger actions when devices enter, exit, or dwell within those boundaries. Retailers use geofences for location-based promotions. Fleet managers use them to enforce speed limits or identify when vehicles reach charging stations.

Mapbox Atlas provides on-premise deployment with Kubernetes support, delivering enterprise-level availability, scalability, and disaster recovery. Atlas supports HIPAA, GDPR, and SOC 2 compliance for organizations handling protected health information or operating under strict data residency requirements.

Terrain data received a substantial upgrade. Developers can now access vector terrain with 10-meter contour intervals at zoom level 15 and raster terrain with 10 cm contour intervals at zoom level 14. This precision represents a 500x improvement over previously available Atlas data.

Pricing follows a usage-based model, which works well for applications with predictable traffic but can create budget uncertainty for rapidly scaling products. The platform requires developer resources to implement, making it less suitable for organizations without engineering teams.

HERE Technologies earned the top ranking in the 2025 Omdia Location Platform Index, which evaluates major location technology providers including Google, TomTom, and Mapbox. The company announced a 10-year, $1 billion cloud infrastructure agreement with AWS to support AI-powered map and location services for automotive, transportation, logistics, and mobility companies.

The platform provides real-time spatial data and 2D/3D map content for 200 countries with more than 1,000 detailed attributes. HERE announced a generative AI vehicle guidance assistant that uses multiple large language models to deliver natural language-powered, location-aware navigation.

HERE WeGo Pro, unveiled at the Manifest Supply Chain and Logistics Summit, targets commercial vehicle fleet operators with optimized multi-stop routing. The product accounts for road restrictions and real-time traffic conditions, addressing pain points that general-purpose navigation tools often miss for commercial vehicles.

Pricing operates on a custom quote basis, and the platform targets large enterprises with complex fleet operations or automotive manufacturers building navigation into vehicles. Smaller organizations may find the sales process and pricing structure less accessible than alternatives focused on mid-market customers.

Blue Marble Geographics released Global Mapper v26.2 at Intergeo 2025, emphasizing usability, dynamic data visualization, and expanded file compatibility. The software supports more than 300 file formats including vector, raster, elevation, and point cloud data types without requiring add-ons or additional licenses.

Global Mapper Pro extends the standard version with advanced 3D analysis, lidar and photogrammetric point cloud processing, drone image analysis, Python scripting, and machine learning integration. The v26.2 release expanded machine learning-based point cloud classification to include powerline detection.

Pricing starts at $700 for a one-time license, making Global Mapper accessible to smaller organizations and individual professionals. The desktop-focused approach works well for surveying firms, engineering consultants, and research teams that process complex spatial data on local workstations.

The platform requires more technical expertise than browser-based business mapping tools. Users working with lidar data, terrain modeling, or photogrammetry will find capable tools at a fraction of what enterprise GIS platforms charge.

CARTO positions itself as the only 100% cloud-native GIS platform, running entirely inside customer cloud environments with no data replication. This architecture appeals to organizations with strict data governance requirements who cannot allow mapping vendors to copy their information to external servers.

Q4 2025 updates introduced Agentic GIS, which automates spatial analysis workflows and delivers insights without requiring manual analysis steps. The platform expanded in Q1 2025 with full capabilities for raster data analysis and visualization from cloud data warehouses. A new QGIS plugin allows users to access, visualize, and edit spatial data from Google BigQuery, Snowflake, Databricks, AWS Redshift, and PostgreSQL directly within QGIS.

CARTO holds SOC 2 Type II certification and provides single sign-on, encrypted connections, granular permissions, and password-protected sharing. The platform targets data teams already working with cloud data warehouses who want to add spatial analysis without moving data to a separate system.

Pricing follows a custom quote model. Organizations considering CARTO should assess their existing cloud infrastructure investments, as the platform works best when data already resides in supported cloud warehouses.

Google Earth Engine provides access to petabyte-scale satellite imagery and geospatial datasets for planetary-scale analysis. The platform serves environmental researchers, conservation organizations, and government agencies tracking land use, deforestation, water resources, and climate patterns.

The free tier for research and nonprofit use makes Earth Engine accessible to academic institutions and NGOs. Commercial applications require paid licensing. The platform runs entirely in the cloud, processing data on Google's infrastructure rather than requiring users to download and store massive imagery datasets locally.

Earth Engine uses JavaScript and Python APIs, requiring programming knowledge that limits accessibility for non-technical users. Organizations without data science or engineering resources will need to hire specialists or partner with consultants to use the platform effectively.

For environmental monitoring, agricultural analysis, and research applications, Earth Engine offers data access and processing power that no other platform matches at comparable cost.

SuperMap serves enterprise customers primarily in China and expanding international markets. The platform offers integrated 2D and 3D GIS capabilities for infrastructure planning, smart city initiatives, and natural resource management.

The software supports both on-premise and cloud deployment, giving organizations flexibility based on their IT policies and data residency requirements. SuperMap provides desktop, server, and web components that work together for teams with different roles and skill levels.

Organizations operating in or with connections to Chinese markets will find SuperMap familiar to local partners and government agencies. The platform may require more evaluation effort for Western enterprises less familiar with its ecosystem and support resources.

Precisely focuses on data quality and enrichment, with Spectrum Spatial providing geocoding, routing, and spatial analysis capabilities. The platform emphasizes accuracy in address validation and location verification, which matters for organizations where incorrect geocoding creates operational problems or compliance risks.

New data from Precisely shows a 62% year-over-year increase in businesses prioritizing spatial analytics and a 22% increase in data enrichment initiatives. The company positions Spectrum Spatial as part of a broader data integrity portfolio rather than a standalone mapping tool.

Organizations that already use Precisely products for data quality may find Spectrum Spatial a natural addition. Standalone mapping needs might find more focused platforms offer better value and simpler procurement.

Alteryx provides low-code analytics workflows that include spatial analysis capabilities. Business analysts who already use Alteryx for data preparation and blending can add location-based analysis without switching platforms.

The software runs on desktop and cloud, with drag-and-drop workflow building that does not require programming knowledge. This accessibility makes Alteryx suitable for business intelligence teams, marketing analysts, and operations managers who need spatial insights as part of broader analytical work.

Organizations seeking a dedicated GIS platform will find Alteryx limited compared to specialized mapping software. As a component of an existing Alteryx investment, location intelligence adds value without requiring separate vendor relationships.

FME specializes in data transformation, supporting more than 450 format translations that allow organizations to move spatial data between systems that would otherwise be incompatible. The platform serves as middleware connecting GIS platforms, CAD systems, databases, and cloud services.

Desktop and server versions handle different workloads, from one-time format conversions to scheduled automated workflows. Organizations managing data pipelines between multiple spatial systems often use FME as the connection layer.

Pricing starts at $4,800 per year for desktop licenses. The platform requires technical expertise to configure workflows effectively but reduces the custom development otherwise needed to integrate spatial data across enterprise systems.

The location intelligence market in the US is expected to grow at a rate of 14.7% annually from 2025 to 2030, driven by integration of artificial intelligence and machine learning into location-based analytics. These technologies help businesses analyze large volumes of location data more effectively, identifying patterns that manual analysis would miss.

Cloud deployments comprised 59.12% of the market in 2025 and continue to grow. Over 70% of logistics companies now incorporate location intelligence solutions for fleet management and route planning. Artificial intelligence and machine learning have improved data interpretation by approximately 45%.

When selecting enterprise mapping software, match the platform to your organization's primary use case. Sales and territory teams benefit from platforms like Maptive that provide turnkey analysis without GIS training. Organizations with dedicated GIS departments and complex analytical requirements will find ArcGIS Enterprise worth the investment. Developer teams building location features into applications should evaluate Mapbox or HERE based on their specific technical requirements.

Budget constraints point toward QGIS for organizations with technical staff who can manage open-source software. Mid-market companies seeking cloud-based solutions without custom pricing negotiations will find Maptive's transparent annual pricing easier to budget.

Security requirements narrow options quickly. Organizations handling protected health information, operating under GDPR, or serving government clients should verify compliance certifications before evaluating features. Maptive, CARTO, Mapbox Atlas, and ArcGIS Enterprise all provide enterprise-grade security, though implementation details differ.

The best selection process involves testing with actual data. Request trials from your top 2 or 3 candidates, load real datasets, and have actual users perform representative tasks. Performance, usability, and fit become apparent quickly when people work with real information rather than demo data.

Insurance and capital markets